Adelante’s Global Real Estate Securities Strategy is designed for institutional and individual investors who recognize the diversification benefits of global real estate in their overall investment portfolios.

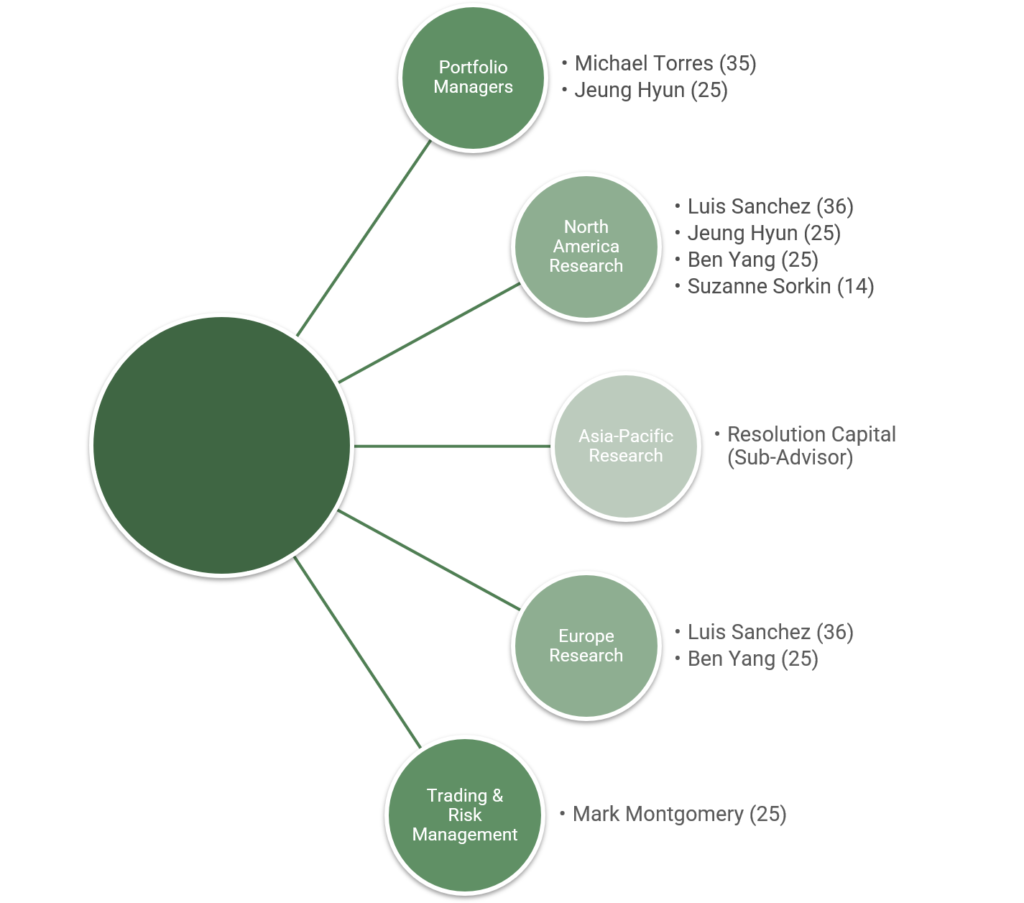

Adelante’s Global Real Estate Securities Strategy focuses on commercial real estate opportunities in three main geographic regions: North America, Asia-Pacific, and Europe. The Adelante Capital Management team has internal real estate investment expertise in terms of the North America and Europe regions. For Asia-Pacific, we partner with a firm in this important foreign real estate sector to ensure we have extensive coverage of companies in Asian markets. Our partner is Sydney, Australia- based Resolution Capital Limited, a leading investment manager of global publicly traded real estate securities. The relationship began in 1997; Sub-Advisor since inception July 2006. Resolution is registered with the U.S. Securities Exchange Commission and has approximately $4.8B AUD in assets under management.

The objective of the Global Strategy is to achieve long-term capital growth and current return by investing in a globally diversified portfolio of property companies in developed countries which are trading at discounts to Net Asset Value.

This strategy is a concentrated portfolio of 30 to 75 real estate securities, predominantly REITs. Given our belief that we are investing in commercial real estate through the public market, our portfolios have low turnover. Our informational advantage is at the local and company level; the portfolio is managed on a region neutral basis by monthly rebalance. Security selection has been the greatest contributor to alpha over the strategy’s 10+ year track record.

( ) reflects years of experience.

Institutional and individual investors can access our Global Strategy through a variety of financial investment vehicles. Please contact us to discuss the vehicle appropriate for your particular needs.