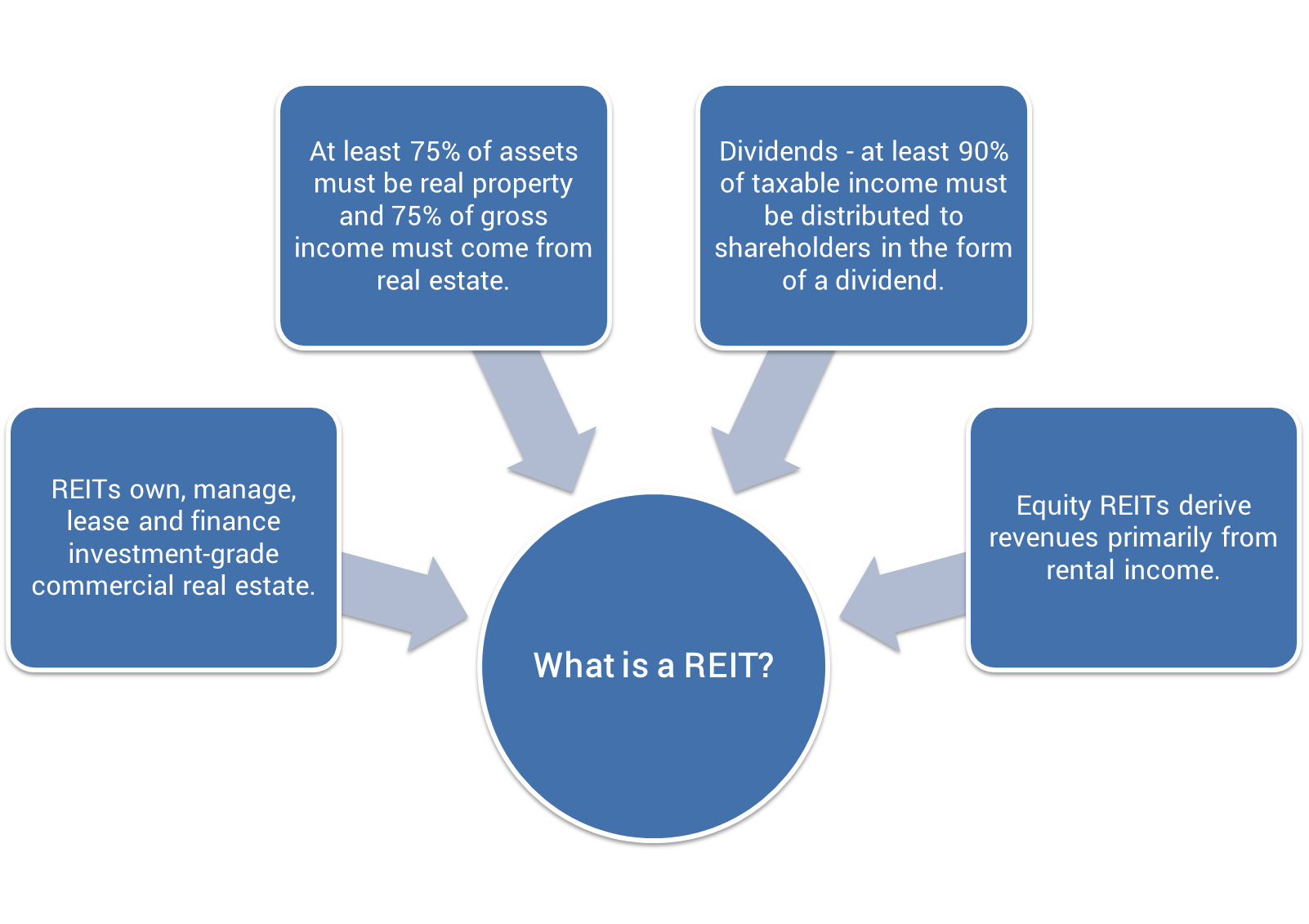

Introduction to REITs

Publicly traded Real Estate Investment Trusts (“REITs”) offer efficient access to commercial real estate with an advantage of liquidity. Investing in listed real estate securities provides diversification and can complement the returns from other stocks and bonds in a multi-asset class portfolio.

Listed Equity REIT Advantages

Listed Equity REIT Advantages

- Efficient access to quality commercial real estate

- Attractive relative long-term investment performance

- Source of dividend income

- Transparency and simplicity

- Diversification benefits

- Liquidity

- Strong, investor-aligned corporate governance

- Inflation hedge (real assets)

Valuation Methods

NAV Approach:

Calculation of the current market value of a REIT’s net assets divided by the number of shares outstanding to achieve value/share.

NAV = Current Value of Real Estate Assets (valued on a pro rata basis using NOI and an estimate of a cap rate for the respective portfolio)

+ Development (valued at CIP + Estimated Value Creation)

+ Other Tangible Assets (marked-to-market where appropriate)

– Debt (marked-to-market based on current prevailing interest rates and spreads)

– Other Tangible Liabilities

– Preferred Equity (marked-to-market based on market pricing where available and prevailing interest rates)

AFFO Approach:

A frequently used earnings-based approach in which a multiple is applied to AFFO/share to indicate a value/share. An AFFO yield is the AFFO per share generated in a stated year as a percentage of the current share price, or the inverse of an AFFO multiple (Price per Share / AFFO per Share). An AFFO yield may indicate that a REIT is undervalued or it may serve as a caution flag regarding the quality of a company’s real estate portfolio, balance sheet, or management team.

REIT Terms

Funds from Operations (FFO):

FFO is an earnings metric crafted by the REIT industry. FFO starts with net income and then adds back depreciation expense under the logic that commercial real estate appreciates over time – it does not depreciate – and REIT earnings would be unduly penalized relative to other industries due to the heavy depreciation expense incurred by real estate owners. The reality is that commercial real estate owners must constantly reinvest capital in their properties to maintain their competitive position. FFO fails to acknowledge this important issue. Consequently, Adjusted Funds from Operations (AFFO), which makes an explicit adjustment for cap-ex, is a superior performance measure. Companies often use FFO definitions that deviate from the NAREIT definition. FFO is frequently quoted on a per-share basis.

FFO

= Net Income

– Preferred Share Dividends

+ Depreciation

– Gains or Loss from Sales of Property

Adjusted Funds From Operations (AFFO):

AFFO is a superior measure of a REIT’s operating performance compared to the more commonly used metric – FFO. The primary reason is that AFFO reflects the large and real costs that landlords incur to maintain their properties over long holding periods. Our calculation of AFFO is:

FFO

– Normalized Cap-ex Reserve

– Straight Line Rent

– Gains on Land Sales

– Minus merchant-building gains

– Extraordinary items such as gains/losses on debt pre-payments

= AFFO

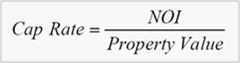

Cap Rate:

A metric industry participants use to gauge the yield of a transaction. Cap rates are typically quoted on a forward one-year NOI basis. Green Street uses four types of cap rates (nominal, economic, implied, and market) to describe transactions and market pricing.

Net Asset Value (NAV):

Real estate differs from many other industries in that the market value of the assets owned by a company can be estimated with reasonable precision. The reason is that numerous sales transactions, involving similar assets, provide excellent “real time” pricing. NAV estimates are the foundation for our NAV-based Pricing Model, which has proven to be highly successful over time for making accurate investment recommendations. NAV is the mark-to-market value of a company’s common equity calculated by applying an estimate of private market values to the company’s real estate and other adjustments and deducting all liabilities, including preferred equity. NAV is often presented on a per-share basis.